The government servant can download the PIFRA Salary Slip 2025 online over here. All those government servant payslips are downloaded free by PIFRA Pay Slip 2025. Since Government Employees have to travel to the accounting office to get their pay salary slips now Government job holders can get Pay slip 2025 by downloading PIFRA online over here. PIFRA Salary Slip 2025 Download Online here. PIFRA Pay Slip 2025 on the Gmail account that you have registered on PIFRA payslip 2025.

What is PIFRA:

PIFRA meaning is a Project to Improve Financial Reporting and Auditing. PIFRA’s main objective of this project is to computerize the whole accounting and auditing system of Pakistan. The idea behind computerizing the whole system is to generate timely accurate and reliable financial statements.

PIFRA Salary Slip 2025 Download Online

Online Pay Slip Payroll Download PIFRA:

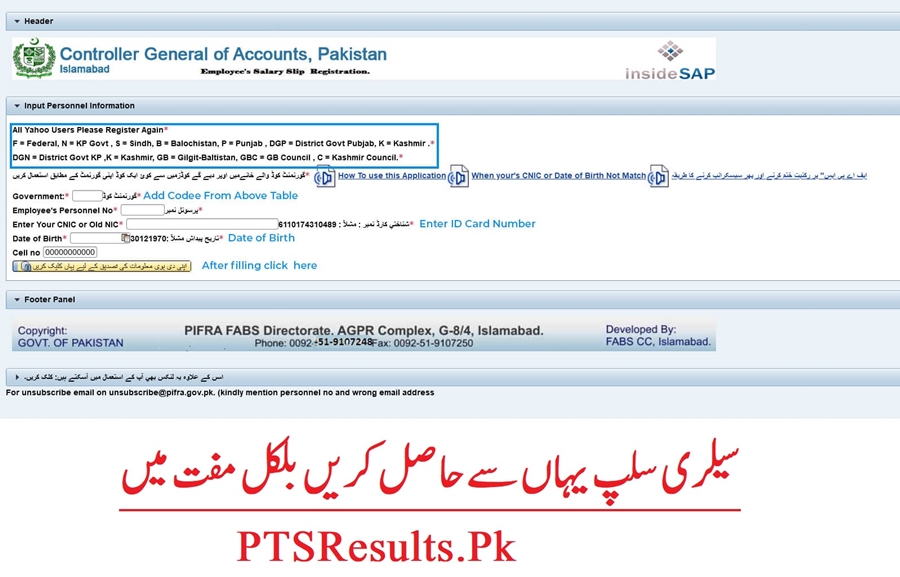

The government servant has downloaded PIFRA Salary Slip 2025 online on this page given the link below. All male and female government servants can download the PIFRA Salary Slip 2025 online from the official website. Here you can get all the details to download the PIFRA Salary Slip 2025 and how to register to forget the PIFRA payslip 2025.

How to Register PIFRA Pay Slip:

Here on this page, we will provide a method of registering PIFRA payslip 2025. Govt servant needs all the documents then the servant can get details to register himself on the PIFRA Payslip 2025 website. All the male and female govt servants will register for PIFRA Salary Slip 2025. All government servants can get payslips from this given link pifra.gov.pk.

Eligibility to Register on PIFRA:

- Must be a Government Servant.

- Personal Number

- Province

- CNIC

- Email ID

- Complete Name to register on CNIC

- Pay Scale

www.fabs.gov.pk Registration slips 2025.

The Government Servant may get information on registering on the PIFRA Salary Slip 2025 website if they bring all of their supporting documentation. Pifra payslips will be available to both male and female candidates.

Salary Slip:

A salary slip, also known as a payslip or paycheck stub, is a significant financial document that presents a comprehensive breakdown of an employee’s earnings and deductions for a specific pay period. It serves as tangible proof of an individual’s compensation, providing detailed information on various components such as gross salary, net pay, taxes withheld, and any additional deductions. Salary slips are crucial for both employees and employers as they aid in monitoring financial transactions, ensuring transparency in payroll management, and validating payment accuracy. These documents play a vital role in financial planning and budgeting, providing employees with a clear understanding of their income and expenses, while employers rely on them to maintain precise payroll records and comply with tax regulations.

Payroll:

The management and disbursement of employee compensation is a critical aspect of any organization’s financial operations, and the payroll department or system is at the heart of this process. This department is responsible for a wide range of tasks, including calculating wages, salaries, bonuses, and deductions, as well as ensuring compliance with tax laws and other statutory requirements. The efficient processing of payroll is essential for fostering employee satisfaction, as it guarantees the reliability and timeliness of paychecks. Moreover, it helps businesses adhere to legal and regulatory obligations, making it a fundamental element in the smooth functioning of any organization. The payroll department or system not only plays a pivotal role in ensuring employees receive their earnings accurately and on time but also assists in maintaining comprehensive records of financial transactions within the company.

Salary Statement:

A salary statement, also known as a pay statement or earnings statement, is a comprehensive document that provides employees with a detailed overview of their earnings for a specific pay period. This document contains vital information, including the employee’s gross salary, which represents their total earnings before any deductions, and the net pay, which is the actual amount received by the employee after deductions such as taxes, insurance premiums, and other withholdings.

Gross Salary:

The gross salary refers to the complete amount of compensation received by an employee prior to any deductions or withholdings being subtracted. It serves as the fundamental basis from which an employee’s pay is calculated, encompassing their fixed salary or hourly wage in addition to any supplementary bonuses, overtime, or commissions they may be entitled to. When individuals enter into an employment agreement with their employer, the gross salary is the initial figure that is negotiated and it acts as the starting point for determining their take-home pay. While it is crucial to comprehend one’s overall earnings, it should not be mistaken for the net salary, which represents the actual amount received by an employee after deductions for taxes, benefits, and other withholdings have been accounted for. The gross salary plays a pivotal role in various financial calculations, such as income tax assessments, loan eligibility, and financial planning, as it defines the total income earned by an individual before any deductions are taken into consideration.

Salary History:

A comprehensive record of an individual’s earnings and compensation over a period of time, typically throughout their career, is known as a salary history. This document details an employee’s salary progression, including the various positions held, corresponding salaries earned, and any changes in compensation, such as promotions, raises, or bonuses. Salary history is a crucial factor in negotiations for new job offers or during performance evaluations. Employers often request this information from job candidates to assess their qualifications and determine a competitive salary offer. Maintaining an accurate salary history is not only valuable for professional development but also for personal financial planning. It can help individuals track their financial progress, set realistic goals, and ensure they are being fairly compensated for their skills and experience. In a rapidly changing job market, a well-maintained salary history can be a valuable tool for achieving career objectives and financial stability.

Government Employee Payroll:

There are several resources available online related to government employee payroll. Here are some of the relevant search results:

Pay Administration – OPM:

- The Office of Personnel Management (OPM) provides leadership on pay administration for civilian Federal employees. They develop and maintain government-wide regulations and policies on authorities such as basic pay setting, locality pay, special rates, back pay, pay limitations, premium pay, grade and pay retention, severance pay, and recruitment, relocation, and retention incentives

- Each Federal agency is responsible for complying with the law and regulations and following OPM’s policies and guidance to administer pay policies and programs for its own employees

Salaries & Wages – OPM:

- The Office of Personnel Management provides policy leadership and expertise on a variety of Government-wide pay programs for Federal employees, including the General Schedule (GS), Law Enforcement Officer (LEO) Pay Schedules, and the Federal Wage System (FWS)

- For more information on the pay tables and related materials posted on their website, agencies may email Pay-Leave-Policy@opm.gov

- Payrolls – SeeThroughNY: The Payrolls section provides a database of names, positions, salaries, and/or total earnings for individuals who have been employed by New York State

- Payroll Shared Services | GSA: The General Services Administration (GSA) provides a full range of payroll services for over 18,600 employees, which includes GSA and more than 30 independent agencies or presidential commissions

- Citywide Payroll Data (Fiscal Year): This dataset is collected because of public interest in how the City’s budget is being spent on salary and overtime pay for all municipal employees

- FederalPay.org US Federal Government Employee Lookup: FederalPay.org has created a powerful search tool that allows public access to the EHRI-SDM dataset, which contains records of most public employees of the United States’ Federal Government. The information available through this dataset may include name, job title, duty station, and salary for most Federal civilian employees

Hello, I am a professional Blogger and I will provide the latest Jobs, Roll No Slip, Results, Merit List, Interview dates, Interview Results, Admission, Scholarships, and all related education information.